Paul and Brett's Alpha

Staying the course

These are challenging times for investors. The market has seldom felt so reactionary and unpredictable. Even as one tries to parse through the rate cycle, credit availability and inflation, a maelstrom of additional macro-economic and geopolitical risks swirls in the background, ever-ready to fan the flames of uncertainty.

However much you know, or think that you know, it does not feel like enough and it can become overwhelming if not managed correctly. We understand the temptation for underlying investors to sit this one out, holding cash or shorter-dated government securities. If nothing else, there is a novelty in receiving a monthly account statement where the interest income is actually a useful amount of money.

As April began, OPEC announced a production cut, reversing the downward move in crude oil prices during March that finally saw prices return to levels enjoyed prior to Russia’s war against Ukraine. Despite widespread agreement that the regional banking situation in the US would tighten credit availability in a manner that would be comparable to a material increase in the Federal Funds rate, the Fed chose to raise rates again anyway.

Shoot first, reason later; every time you think we are getting somewhere, another gale blows the markets off course. This reminds us of COVID, where collective group-think and the need for governments to be seen to ‘be doing something’ led to some ill-judged policy decisions, many of which are still reverberating through society today.

How is the fund manager’s time best spent in these circumstances? Should one be stuck to the screens watching every tick up and down and trading around the margin, or should one be deep in the weeds of the macro, trying to work out how much market risk to take on? Alternatively, should one minimise the market screens and get stuck into some reading and meeting companies, looking for the next wave of interesting fundamental ideas?

There is no right or wrong answer to the question posed above, there are merely preferences. Perhaps the first two options could help manage performance or curtail volatility in the short-term.

Ultimately though, there is an investment mandate in place for the funds that we manage and investors rightly expect us to focus on the objectives of that mandate. As a reminder, our mandate includes the following:

Provide Shareholders with capital growth and income over the long term… to (i) beat the total return of the MSCI World Healthcare Index (in sterling) on a rolling 3 year period; and (ii) to seek to generate a double-digit total Shareholder return per annum over a rolling 3 year period.

It does not seem unreasonable then to conclude that a long discourse on how we are focusing on market-timing and short term trades would not meet with widespread approval, and rightly so.

Even if one were to leave the mandate aside, trying to time this market seems a very futile exercise, as it does not appear to be following any historical patterns very well. This is amply evidenced by the poor performance (relative to history) of many leading global equity single-manager hedge funds during 2022 and so far this year.

Scylla and Charybdis

When sailing in dangerous waters, one must be careful to avoid a route that forces one to choose between bad options – a rock and a hard place if you will. We do spend a lot of time thinking about the macro-economic outlook and our view on this is probably evident from our previous prognostications. We think the Fed has got this wrong and had said so long before SVB illustrated the dangers of rapid rate rises.

We are in the second year of an aggressive tightening cycle and still the end (i.e. inflation pegged back to a level that allows manageable economic growth, whatever that means) is not in sight. We understand the central banker’s compulsion to try to ‘do something’, but the drivers of inflation in the current environment feel immutable.

There are no short-term fixes to our energy supply concentration, nor any amount of rate rises that will end the war in Ukraine and return it and Russia to their previous positions in the global food supply network. Meanwhile, there are ever more people chasing scant natural resources and yet the Western nations must contend with an ageing population.

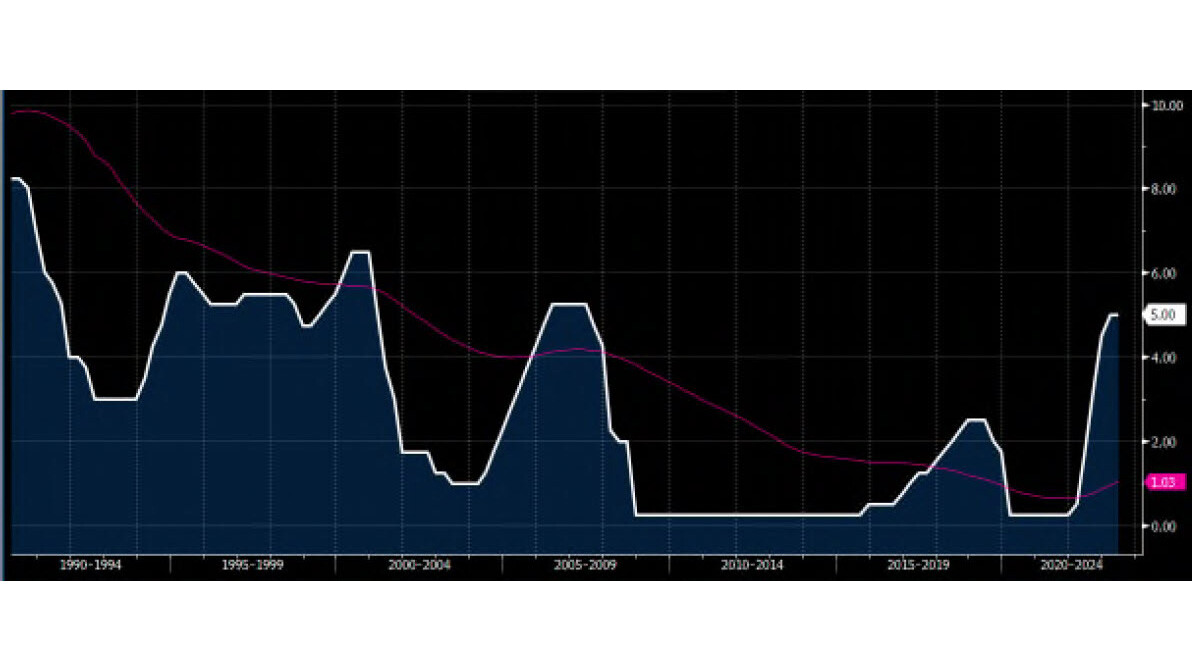

And this is where we feel that the rate cycle may become a significant problem. As we have noted in a previous missive, an ageing population will consume less resources per capita over time, all other factors being equal. This is a structural drag on growth and one that is surely evident in the long-term interest rate trend (Figure 5), and thus the economy requires gentle but continuous stimulation.

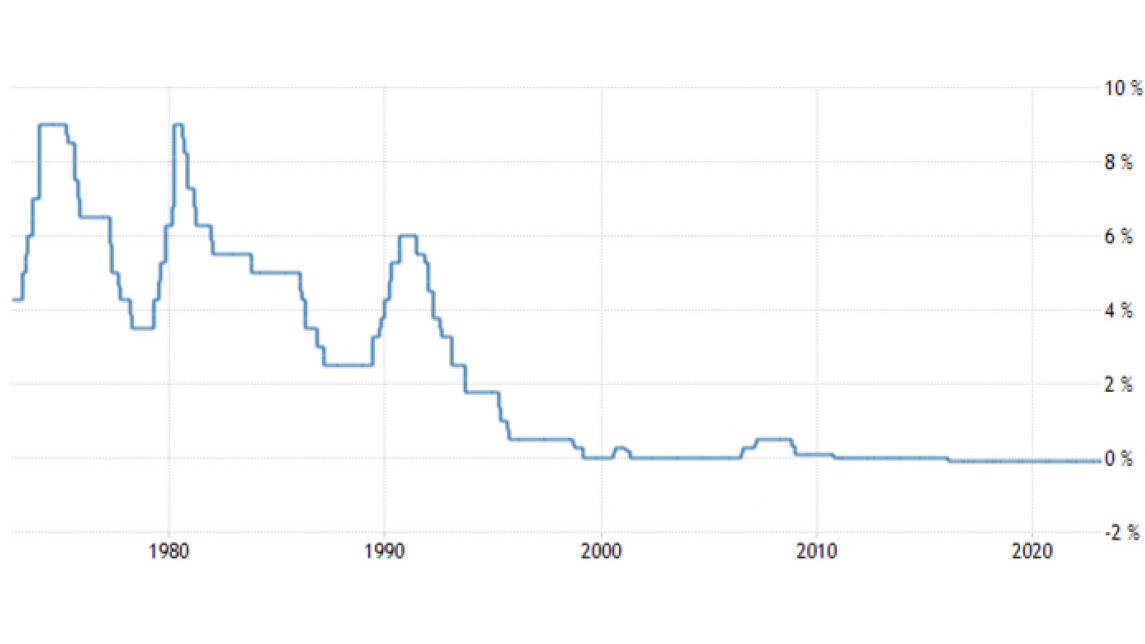

Japan has the world’s lowest interest rates (-0.1% since 2016, and an average of zero since the financial crisis) and has done so for many decades – an average of 2.3% over the past FIFTY years (Figure 6). Surely it cannot be a coincidence that it also has the world’s oldest population (for an industrialised nation, we ignore the billionaire’s Disneyland that is Monaco).

US Federal Funds Target Rate – Upper Bound, 1990-Date

As the trend line in both countries show, the natural course of peak rates at each cycle is for it to be lower over time. We are close to breaking that trend in the current upswing. This may be looked upon in due course as a mistake, engineering a ‘hard landing’ recessionary scenario, that is in nobody’s interest.

Those of a Monetarist bent have even more reasons to fear the Central bankers have gone too far. Broad money supply measures much as M4 are showing rapid contraction in the US and the UK and money velocity (a measure of transactional frequency in the real economy, as opposed to simply measuring the amount of money, which could be sat idle in deposit accounts) is also slowing rapidly. Monetarists argue these are reliable portents of recessionary economic contraction. You can reduce money supply or raise rates, but seldom has anyone tried to do both at the same time to the extent currently under way.

Our voice in this discussion is a moot one though. Central banks will do as they please and by acting together they all provide cover; no-one stands out and it’s a consensus call, just like COVID (Japan is not raising rates despite inflationary pressures but is using unconventional approaches to shape the yield curve in other ways and widely is criticised for its inaction on the core interest rate).

You can understand the market’s painful spasms though, the volatility is surely telling you that something isn’t right. You can perhaps also understand why we are so exasperated by the so-called global political elite and their antediluvian approaches to managing the complex system that is the global economy.

Where does this leave us? March was a painful month, but it was also a very productive one and we would rather focus on the forward-looking positives than the short-term negatives brought about by market vacillations.

Misguided?

Whilst pontifications on the far future as the market whipsaws might sound like ‘fiddling while Rome burns’, the undeniable reality is that we are living in a period of very significant scientific progress. The treatment modalities of today will seem antiquated in a few decades time and the future is unfolding now. Given the longer-term nature of the investment mandate, surely that is where our attentions should remain focused?

The cultural persistence of idioms is a fascinating aside. Whilst Rome did burn in AD64, Nero’s role in this and his alleged ‘amore’ for the ‘amati’ is much debated. The more important point is that the city was rapidly rebuilt and came back stronger than before.

Much of what we now know as ancient Rome stems from the post-fire period. Rome remained the pre-eminent capital of Europe for another 700+ years. When viewed in the context of Rome’s broader 1,100 year central role in European history and culture since 350BC (you could argue longer if you subsume the later Vatican period and ongoing influence of the Catholic Church into the mix), the great fire of Rome is an irrelevant blip in the annals of history.

Even in the Trust’s short history, there have been many learnings along the way. For those who love science, there is a beguiling appeal in “cool” innovations that offer the promise of revolutionising medical practice. However, this does not need to have anything to do with being a good investment.

We have put in place an investment process that involve many steps and a degree of a ‘cooling off period’, to avoid the siren call of seductive science. We also limit ourselves to companies at a development stage where clinical data beyond ‘proof of concept’ is available; data that allows us to assess the potential economic as well as medical impact.

Per last month’s missive; Google did not invent the web, or the internet browser. However, they did destroy (in an unintentional and valid way) the business models for the early innovators who paved the way for their existence. Being first is not always the same as finishing first and thus not a guarantee of investment success.

By the same token, one can look at an area of medicine or an approach through the lenses outlined above and easily conclude that it is not (yet) aligned with our objectives and investment approach. However, that cannot ever be a fixed view. Every assumption one makes, be it a positive or negative one, needs to be regularly challenged. Do we have the right thematic exposures? Are we playing these via the best companies with the highest operationally geared exposure to those themes? Has the competitive landscape evolved?

Trade routes re-open

The reason for the welcome increase in productivity mentioned above is the normalisation of our routine back toward pre-COVID norms which allows more effective use of our time. The calendar is once again full of travel to the US and also full of meetings in London where people are coming to see us. Whilst we have made as best use of virtual meetings as we could, there is nothing to beat the immersion of back-to-back meetings, where you can see a number of key players or emerging disrupters in a given field over a short period of time.

Since the end of February, your managers have seen c40 senior management teams (mostly companies that are not in the portfolio) and a similar number of “key opinion leader” (KOL) physicians across various areas of healthcare in-and-around five investor events in the US, plus meetings here in London.

The value of such broad and deep research with the ability to prepare for it all in advance cannot be over-stated, and has been sorely missed on our side. We have enjoyed a combination of contiguous meetings with multiple companies and relevant KOLs over a compressed timeframe and immersed ourselves in the latest issues around cell therapy, gene therapy, gene editing, synthetic T-Cell receptors, home haemodialysis, fibrotic diseases, chronic kidney and end-stage renal disease management and the hospital capex cycle.

We have been able to meet with companies from China and Australia as well as from the US and Europe and challenged a great many of our working hypotheses. Some have stood up to this test and some need to be revisited in more detail.

Content aside, the most interesting element of our travel schedule has been its loneliness. Analysts and investors are pack animals; we seem to pop up in the same places at the same times and there is normally a familiarity to the audience for these events and a good degree of bonhomie and discussion about the state of the world. Our adventures since Q4 2022 have so far felt very different; we have often been the lone European investor on a trip or at a meeting and even within the US environment, some of the familiar faces have been notably absent, and not because they have left the industry.

There could be many reasons for this; some people may feel that the virtual approach is more than good enough. Some people may not want to travel anymore now they have enjoyed a break from it. As we all know, business travel is far from glamourous, it’s an exhausting schlep of endless meetings and bad food. Nevertheless, we would argue that it is still far more effective than chatting over Zoom or Teams.

Perhaps some fund management companies have enjoyed the absence of the travel costs from their P&Ls and are now less willing to open the purse. Perhaps it is just too early in this ‘normalisation’ cycle post-COVID. Time will tell. If we were underlying investors, these are certainly questions that we would be asking fund managers, such is our view on the value of these trips.

We can at least be thankful that no such restrictions apply at Bellevue Towers; there is always a flexible budget for travel and research. We expect that the fruits of these labours will become more visible as 2023 unfolds and we can share these developments with you in future missives (once we have deployed capital accordingly).

We always appreciate the opportunity to interact with our investors directly and you can submit questions regarding the Trust at any time via:

shareholder_questions@bellevuehealthcaretrust.com

As ever, we will endeavour to respond in a timely fashion and we thank you for your continued support during these volatile months.

Paul Major and Brett Darke