Paul and Brett's Alpha

Twitter ye not

Sadly, we live in a reductive age, where people seem to want 240 character explanations to complex problems and for others to proffer beguiling binary solutions. Oh that life were so simple! Discourse becomes fissiparous and there is a tendency to focus on the minutiae rather than taking a top down view which encapsulates the inevitable trade-offs and compromises that workable solutions to real problems entail.

If history tells us anything, it is surely that the skilled diplomatist is one who recognises that you cannot always get what you want or even what is morally just, but you can find a solution acceptable to a plurality which, in the end, is what moves things forward. This reality of how progress is actually achieved is evident not just in geopolitical assessments but also in broader questions, such as the one that occupies much of our time – what does the future of healthcare look like?

When people from outside the world of finance or healthcare ask us about the fund’s investment strategy, they often appear to want us to ultimately describe some sort of magic bullet: a product, service or technology that is readily understandable and, at the same time, capable of fixing “the problem” (whilst also making us some money).

We can assuredly confirm that, upon finding such a bullet, we will be telling no-one else about it. However, we don’t expect this to ever happen, because life is never so simple and straightforward. Fixing healthcare is not some grand gesture easily articulated and rapidly deployed. If it was, then the political classes across the OECD might actually try to implement the changes. To our minds, the future will not arrive with a bang, but through a million mellifluous whimpers.

Why do we think this? The solution will be multi-faceted because the problems arise from the interplay of many sub-optimal conditions. Trying to articulate this is harder of course and inevitably gives rise to the concern that the future will never arrive because no-one can see it. One can easily descend into some sort of absurdist Samuel Beckett existentialism. However, we know that Godot is coming, because we have seen him already

How can we be so confident? In order to illustrate the solutions, we could start by trying to summarise the problems. We will of course focus on the US because it is both the largest and most important marketplace, representing ~$4trn of the global total healthcare spend of ~$10trn, but also because it is where the necessary changes are taking place first for various reasons that would occupy a factsheet on their own.

Readers can later decide for themselves the extent to which these models and solutions might be applicable to our own benighted NHS, given its unionised workforce, leviathan structure and sanctified totemic status amongst the electorate. Personal interest aside, it matters little for the Trust, since the UK only accounts for ~2% of global spending on healthcare.

Dimensionalising the problem

When trying to sound intelligent whilst discussing a complex issue, the first resort of the clueless is to ‘engage with stakeholders’ using impressive-sounding but ultimately vacuous terms. We thought we would give it a go too, hence the section title, but maybe not. Phrases like this one might seem very at home on the websites of leading consulting firms, but they feel at odds with our more practical approach.

Trying to be sensible then: we can think of four principle reasons why the US healthcare system delivers below OECD peer group outcomes despite materially higher relative expenditure:

1.The absence of a widespread primary care (i.e. family doctor) model to allow a holistic relationship-based care package to be put in place, including preventative care. In the US, only about 75% of the population are registered with a family doctor (it is high for the elderly but less than two thirds for the under 30s), whereas the ONS data for the UK suggests it is very close to 100%1.

2. Uneven access to healthcare in the first place, particularly for lower socio-economic groups who are more likely to face health risks owing to their environment (workplace and domestic). Self-evidently, you won’t initiate primary care involvement if you cannot afford the cost and a pre-COVID survey found that 32% of American families had elected not to seek care in the prior year owing to cost2 (as an aside, one might wonder what percentage of families here in the UK have given up trying to get care because it is so hard to get a GP appointment, but that’s a topic for another day).

3.The prevalence of a fee-for-service model where there is no disincentive not to treat someone as expansively (read: expensively) as possible.

4. High medical malpractice liability risk: this compounds the previous point. Diagnosis is imperfect and diagnostic errors can lead to serious harm, especially if emerging critical care events (such as a heart attack, stroke or sepsis) or an early sign of cancer are (dis)missed. These three categories (CV, infection or cancer) of misdiagnosis account for three quarters of adverse events from misdiagnosis and half of all US medical malpractice claims. The payouts can be very large if people die or suffer irreparable harm, creating a climate of fear that causes American doctors to apply a very low index of suspicion before ruling things out and over-treat due to fear of being sued3.

Trying to fix all of the above would likely require a combination of two things; 1) comprehensive healthcare reform to address the first three things and 2) so-called ‘tort reform’ to cap malpractice payouts at a level that might impact behaviour and thus reduce over-treatment.

Turkeys don't like Christmas

Let us first consider the tortured history of tort reform. Readers will doubtless be aware that most members of Congress have legal backgrounds and owe their place in politics to an earlier career helping people to navigate the complexities of the legal system. As such, they tend not to be so keen on making it less complex and less remunerative. Even in the early 2000s, 70% of malpractice lawsuits did not result in an award to the plaintiff, but still resulted in six figure legal costs for the defendant. One cannot imagine the situation has improved much since.

George W Bush (the second one) generally gets a bad rap. Critics tend to focus on the illegal wars and the hundreds of thousands of people that died in them, the rendition of individuals from sovereign states, the legalisation of torture, the unlimited detention without trial and the blocking of access to birth control in developing nations. He also set a precedent for legally contesting the outcome of the Presidential election and genuinely seemed to like Tony Blair.

However, if we set aside these things for a moment (bear with us), he tried to do some good stuff around healthcare access and affordability. He implemented “Medicare part D”, which helps to fund drug costs for retired seniors. He tried to instigate a widespread healthcare reform package where tax free savings accounts would be allied to catastrophic coverage insurance (i.e. a cap on out of pocket costs) to protect people from huge medical bills. The proposal would have coerced States into dealing with their uninsured populations by linking Federal funds to this outcome. The package did not make it through Congress, but was no less progressive or ambitious than the eventually successful “Obamacare” that followed a few years later.

Finally, he created PEPFAR, which continues to this day and has undoubtedly done more to slow the spread of, and mortality from, HIV in developing countries than any other programme. Indeed, until COVID-19 it was the world’s largest public health initiative and is estimated to have saved millions of lives, making it one of the most successful preventative healthcare programmes in human history. As we noted at the beginning, few things are simple binaries of “this thing or person is wholly good or bad”.

Whilst he was Governor of Texas, Bush successfully passed laws (seven in total) to limit damages payouts against businesses, doctors, health insurers and hospitals. In the years that followed, the number of such cases fell materially, as it was judged in many instances that the financial risk of pursuing a claim were not worthwhile. Some meritorious cases might well have fallen away due to these changes, but few would argue that the State had the right balance between plaintiff and defendant rights prior to his efforts.

Around the same time, Congressional Republicans made similar reforms a centrepiece of their ambitions for their agenda under President Clinton but he vetoed the relevant bills (Clinton graduated Yale law and was a professor of law before going into politics). Bush also tried to pass similar Federal laws as those that he successfully implemented in Texas, but to no avail. Various attempts to address the issue resurface every few years (2017 being the last one we are aware of).

The United States has a uniquely litigious culture and this undoubtedly impacts healthcare. No real progress has been made on this issue and we doubt that it will until another politician comes forward with tort reform as a centrepiece of their Presidential campaign. If we cannot rely on changes to the law to mollify the tendencies to over-treat, perhaps the broader fee for service model can serve as the basis for a more rational approach to care provision and access.

Value based care - perhaps there is a magic bullet?

As noted previously, Bush’s attempt to pass a comprehensive healthcare reform bill was unsuccessful, but President Obama did manage to pass the Affordable Care Act (‘Obamacare’) in 2010, and this came into effect in from 2013 to 2014. The primary focus of commentary on the Bill has been around its success in reducing the number of uninsured Americans and the various Congressional attempts (60 and counting) since its passing for Republicans to defenestrate it, especially under President Trump.

The success of Obamacare cannot be questioned: there are fewer uninsured Americans today (roughly half as many) and, in the States that elected to expand Medicaid provision under the Act, morbidity and mortality amongst eligible populations has declined. The insurance pools have not worked as well as was hoped, so the cost of care is higher than was projected at the time of the Bill’s passage, but it is a qualified success.

From our more ‘wonky’ perspective, one of the principle points of interest for us in our past lives was the Act’s role in supporting so-called alternative payment models and value-based care through the creation of Accountable Care Organisations (ACOs) through the Medicare Shared Savings Program. This represented an evolution of the 1970s HMO model and the two differ in the sense that an HMO provides a fixed type of care package for a fixed price, whereas an ACO is less prescriptive in terms of the care on offer.

In simple terms, the Value Based Care (VBC) or “population health” model promotes holistic care. Instead of relying solely on episodic payments for each individual unit of service or care episode (commonly known as fee-for-service, FFS), VBC focuses on the quality and total cost of care. A primary care physician is responsible for disease management/health maintenance.

Two different models exist, known as one and two sided risk sharing. In both cases, the fee for service element continues but providers who deliver high quality care while reducing costs are able to share in the financial savings. In a two-sided model, the outcomes payments are higher but on the other hand, providers who deliver lower outcomes and or higher costs must fund the difference.

Around 70% of healthcare spending goes toward the treatment of chronic diseases and we know that costly and debilitating exacerbations related to conditions such as high blood pressure, high cholesterol, high blood sugar etc. represent ‘modifiable risk factors’. Simply put, if we can make people change their behaviour (medically or otherwise), we can reduce the risk of these acute events.

Given how wasteful healthcare is and in particular how the US system ends up spending a lot more than other OECD countries for generally poorer outcomes, this seemed like a fantastic business opportunity to us and we expected VBC schemes to attract lots of lives and for the number of ACOs to mushroom in the years after the passage of the Act.

However, this view proved to be premature. Medicare ACOs still only covered ~10.5m lives in 2021, out of a total of ~64m in the wider Medicare programme. This is despite the majority of ACOs hitting their care quality markers and still generating savings amounting to almost $2bn per annum from those 10.5m lives when compared to traditional Medicare. Why hasn’t it been more popular?

Sumptuary saprophytes

One cannot under-estimate the extent of the change in system-wide behaviour that the ACO model represents. Whilst HMO models are the most common type of insurance in the US and consumers are used to being told what is and is not covered and where they can or cannot go for care, the physician has always had the fee for service model. If they come, you can bill them. You just need to be the right side of the fee cut-off line to ensure that the insurance companies will reimburse your time.

As such, the ACO model represented a new challenge. You would realise bonuses or maybe receive a bill based on a nebulous concept of patient satisfaction and health outcomes. Physicians know better than most of us that people rarely follow medical advice. Moreover, the model dictates that you identify those with material risks and then optimise their care. Is this as easy in reality as it sounds on paper?

Pareto’s law applies in healthcare as it does to everything else and failing to get that smaller proportion of higher-risk patients where they need to be could compromise your overall effort. In addition, the intensity of care means that you cannot look after as many patients (as you need to see them more often). Shrinking your book of business is an anathema to anyone trying to earn a living (although the data shows that overall primary care earnings are not lower and can be much higher).

Finally, we must not forget that most physicians are not all about the green. They have pledged an oath to do no harm and went into medicine to help people. There has been concern that ACO systems and their bundled care approach (with hospitals and other providers working with family doctors to provide a vertically-integrated care paradigm) could worsen clinical outcomes. Aside from the financial risks emerging from this, if you really are concerned about poor outcomes, you are not going to sign up. As a result of these reasonable concerns, physicians have proven to be more reluctant to join organisations and thus for existing ACOs to recruit more doctors and grow their business than we initially hoped.

The scores are in

The challenge posed by the arguments above is the difficulty in refuting them. As noted previously, the burden of care stems mainly from chronic disease and the additional exacerbations resulting from sub-standard disease management could take years to become apparent. However, the data is coming through and now the pandemic is largely behind us, we expect the transition to accelerate.

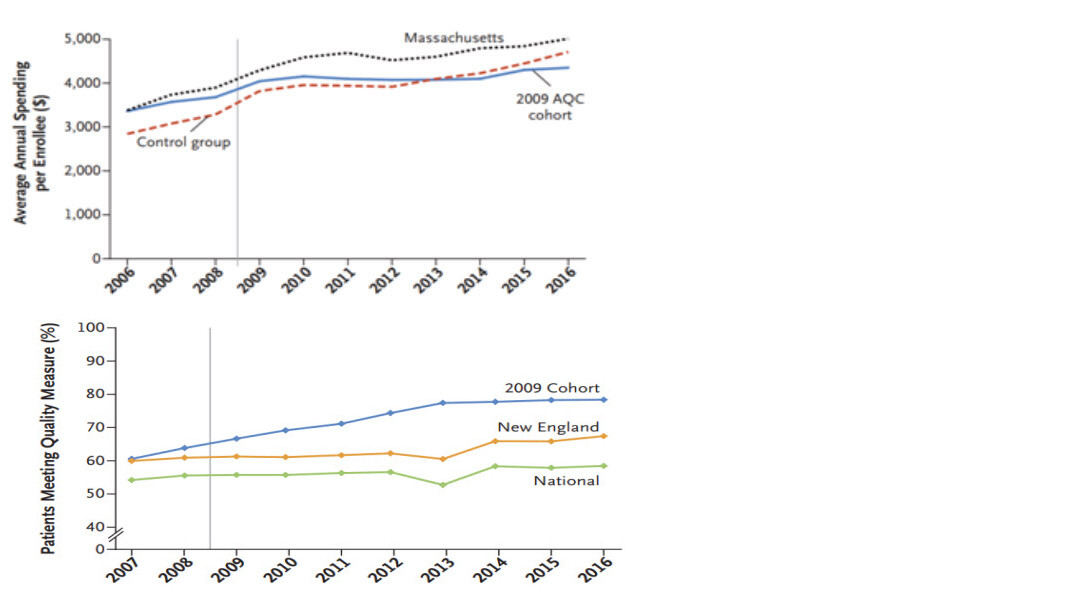

There are innumerable papers that one can look at to see the impact of these sorts of programmes, but an 11-year study reported in the New England Journal is particularly interesting4. It covers a two sided VBC programme introduced by the State of Massachusetts in 2009 known as “AQC”. We include two charts from this paper; one showing annualised spending versus a control group (which is from multiple states and not adjusted for any incentive payments) and an average for Massachusetts (more useful in our view) and the other showing a measure of the outcomes quality:

Whilst this cohort looked to be on a more positive trajectory in terms of spending and health quality (i.e. they were a bit healthier on average), the gap on spending widened and persisted over time whilst outcomes also further improved. In light of these sorts of findings and ever more learnings on how to manage patients better in these schemes, the savings are growing and the incentives to deploy this approach become more compelling over time. VBC and population health have finally come of age.

Capturing a data vertical on the patients is a key element of measuring and improving quality and we are seeing these captive lives being used to support the ongoing site of care shift, with more VBC patients being sent to cheaper-to-run ambulatory care centers (ACCs) for any non-emergency specialist treatment. This is supporting a build-out of additional ACC capacity which creates a virtuous circle of lower cost care capacity for everyone.

Because the physicians themselves are so incentivised to do what is best for their patients in the longer-term, we also think the VBC transition will accelerate the ultimate site of care shift – one where care is given in the home (and again this is a trend that has accelerated as a consequence of the pandemic).

Competitive consequences

We expect the acceleration of value based care within Medicare and beyond to have meaningful competitive consequences for the healthcare landscape in US healthcare. Physician time is finite and the key to all of this is identifying who to spend the most time with and what to do with that time – Pareto’s peremptory. One must also recognise that the savings accumulate over time and so this time represents an investment. It probably has a negative NPV initially but will payback over multiple years. If this sounds like the work of an algorithm, then that’s because it is. Those with the best data on how to do the most in the least amount of time will get the best outcomes.

As a physician, you don’t want to be partnered with the wrong providers. As such, it does rather feel that United Health is incredibly well positioned to take additional share over time. We don’t generally like conglomerate business models, but when it comes to building a healthcare data vertical, there is no other way. Our other major bet in this area has been Evolent Health, which is a software provider that provides the administrative and clinical analysis software to enable smaller entities to run VBC programmes.

As noted previously, we also expect the site of care shift away from the traditional hospital setting and toward care at home to accelerate post COVID and in lock step with growing penetration of population health initiatives. This is reflected in our portfolio with Option Care Health (home infusion services), Amedisys (broad-based medicalised care in the home setting) and Outset Medical (transition to home haemodialysis for ESRD patients) all featuring in the top 10 holdings.

Many of you will have heard us talk about the trifecta of perfection for a product, technology or service that we would want in a prospective investment: it will improve patient outcomes, it will lower the cost of care and it will enable caregivers to make better decisions on behalf of their patients (in truth it is often this third aspect that drives the first two). The data presented above suggests that population health approaches, through the application of financial incentives, do indeed tick all of these boxes. The future of healthcare, in the US at least, is already here.

We always appreciate the opportunity to interact with our investors directly and you can submit questions regarding the Trust at any time via:

shareholder_questions@bellevuehealthcaretrust.com

As ever, we will endeavour to respond in a timely fashion and we thank you for your continued support during these volatile weeks.

Paul Major and Brett Darke