Paul and Brett's Alpha

Oncological obtrusion

There is a lot of depressing stuff going on in the world right now and we are hardly bringing levity to proceedings with the cold fact that 40% of the people reading this missive will be diagnosed with cancer during their lifetimes. Of those whose death is attributed to this awful affliction, half of them will at least be over 70, but a good innings already lived will be scant consolation to their loved ones.

Cancer is cruel, but for many the treatment is equally as bad; therapy courses are often limited not by what is optimal from an efficacy perspective, but by what the patient can endure. For all the medical progress, we still ply people with poison in the hope that their fast-metabolising cancer cells will die in disproportionate numbers. The nerves, immune system, gut and hair follicles are similarly bestowed with high metabolic rates, leading to all the horrendous side effects this approach entails.

Whilst we have made some progress in prolonging life over recent decades, for many, their treatment will bring only a few months of additional survival, the quality of which is always the most important question. There are two key drivers of improved cancer survival rates (that means living longer, not being ‘cured’): earlier diagnosis and improved treatment. Let us put diagnostics to one side for now briefly summarise the progress made in non-radiation treatment over the past century or so.

Chemotherapy treatment for cancer began in the late 1930s, initially using the chemical warfare agent known as HN-2 nitrogen mustard that was created during the First World War (and banned by the Geneva Convention in the 1920s). Various less toxic derivatives were subsequently developed specifically for treating cancer. This was followed shortly by the first anti-metabolites in the 1940s, which blocked metabolic activity. The 1950s and 1960s saw a raft of novel poisons that interrupted cell division and proliferation come to market, and increasingly these were used in combination to enhance their cytotoxic effects.

The 1970s arguably mark the emergence of the first targeted chemical agent, Nolvadex (tamoxifen). Rather than seeking to poison fast growing cells in general, this specifically blocked oestrogen receptors and thus was useful for treating and preventing the recurrence of hormone-positive breast tumours but still there were long-term side effects given the wide-ranging role oestrogen plays in female health (the surgical removal of the ovaries that produce oestrogen to reduce breast cancer risk or recurrence is a long-standing surgical approach).

More advanced targeted treatments slowly began to emerge, whereby antibodies targeted receptors that were over-expressed on certain tumours. Roche/Genentech’s Herceptin (approved 1998) and Rituxan (approved 1997) were the first such therapies but were still reliant on the co-administration of cytotoxic agents for the primary treatment of the relevant cancers.

The next major step forward arguably came with oral tyrosine kinase inhibitors such as Gleevec (approved 2001) and Iressa (approved 2002, albeit later withdrawn and then re-authorised). As pills, these offered a more convenient, potentially longer-term therapy for certain tumours that would, like Nolvadex, help to reduce recurrence.

Aside from expense, the problem with these highly targeted approaches is that cancers routinely mutate and, over time, it is likely that some cells will evade this particular signal and then begin to proliferate anew. Small molecule tyrosine kinase inhibitors are now a widely used group of therapies across a range of cancers but have seldom displaced concomitant use of other therapies with broader toxicity profiles in first line treatment. In short, treatment tolerability has improved less than outcomes.

Another great hope was the development of Avastin (approved 2004), the first drug to target the growth of new blood vessels. It has been well understood since the 1970s that a tumour mass cannot grow beyond a certain size without a dedicated blood supply and by inhibiting this, tumour growth should be suppressed. While Avastin has demonstrated utility across a range of tumour types, it tends to be effective only when combined with cytotoxic therapies and is not without burdensome side effects in and of itself, limiting its usage to only a sub-set of patients.

A Brave New World

A decade or so ago, many of us believed that a new era of oncology was just around the corner (we could have said “hoped” instead of “believed” but in truth we, like many others, really felt this); one where the cytotoxic therapies might be consigned to history, replaced by the emergence of a new generation of therapies seeking to harness the immune system as the cornerstone of chemo. The ASCO oncology meeting was the banner event of every investor’s year, and there were probably as many investment professionals as medics, pouring over data to find the next ‘big thing’, generating literally thousands of pages of sell-side research.

The most interesting question about cancer is surely not “why does it kill one in six of us?” but rather “why we do not all get it?”. The answer lies with our immune system. Cancer begins when cells malfunction and proliferate in an uncontrolled manner. These malfunctions occur because of random mutations during regular cellular turnover and this stuff goes wrong A LOT.

By way of an example, consider the beautiful, flawless skin of a newborn baby, free from moles, papules and blemishes and then look at your own skin. Each of those discolourations is an aberration of cellular proliferation and many contain B-RAF or FGFR-3 mutations that are associated with skin cancer. For most of us, these marks are of no concern. They are not, nor will they become, cancerous lesions.

Why is this the case? That is an incredibly complex question, but the simple answer is that the body produces signals that turn these cells quiescent (i.e. they become dormant and no longer divide). There is an old saying “Never scratch a mole”.

Whilst it is highly unlikely one could transform a quiescent cell body into a malignancy, experiments with zebra fish (a model animal for melanomas) have shown that repeated injury of a benign skin growth, inducing cell division as part of the repair and healing process, can indeed turn them cancerous by over-riding the quiescence process.

The immune system plays a key role in this process of cellular quiescence, and some cancerous cells continue to grow and spread because they produce chemical signals that neutralise these immune responses, evading shutdown. Some have likened these signals to a cloaking device.

In a healthy individual, the natural role of these ‘checkpoint’ signals is to modulate the intensity of the immune response. As is all too evident from debilitating auto-immune diseases such as arthritis or Crohn’s, the immune system has a powerful arsenal of weapons that are capable of wanton destruction in a scorched earth defence against invading pathogens.

These auto-immune diseases arise when the immune response goes haywire and attacks healthy uninfected tissue, and blocking of various checkpoint signals has been shown to play a role in the development of diseases such as rheumatoid arthritis. Whilst you do not want to let the immune system run amok, you do not want to overly suppress it either: organ transplant recipients taking immuno-suppressive medicines to prevent organ rejection are at a two-fold increased lifetime risk of cancer.

Many people will cite the early 2000s as the dawn of immune therapy for cancer, but the observation that the immune response could target tumours pre-dates this period by more than 100 years: in 1891, a physician called William Coley at Memorial Sloan Kettering used an early form of immunotherapy (called ‘Coley’s toxin’: fluid isolated from skin infections and containing a bacterium called Streptococcus Pyogenes) into soft tissues sarcomas to induce an immune response. He published a paper citing positive results in 10 patients that was largely ignored, probably in part because x-ray therapy had just become possible and was being widely promoted.

With greater understanding comes greater sophistication and the modern era has been about ‘checkpoint inhibitors’ that are supposed to prevent tumours from evading the immune response by shutting down these modulating signals, and ‘immune primers’ that are akin to hitting the accelerator pedal on the immune response, encouraging it to unleash the big guns.

The Floors of Perception

Checkpoint inhibitors have proven to be very effective in melanoma, but that is a cancer which has a propensity to self-resolve in some fortunate people and so is perhaps not a good model for assessing wider anti-tumour efficacy. We have so far seen approvals (initially in melanoma) for three checkpoint signals: CTLA-4 (first approval 2011), PD-1/PD-L1 (first approval 2014) and, more recently LAG-3 (approved 2021). These have also latterly found their way into first line treatment for a broad range of ~20 solid tumours.

However, they are no panacea. Hippocrates ‘rule of thirds’ has been painfully evident, with around a third of patients not responding to these drugs, a third responding incredibly well and a third not doing as well as expected. Predicting who will fall into which bucket has been more difficult than initially hoped, and at $10,000 a month or more, that is potentially a lot of wasted resources.

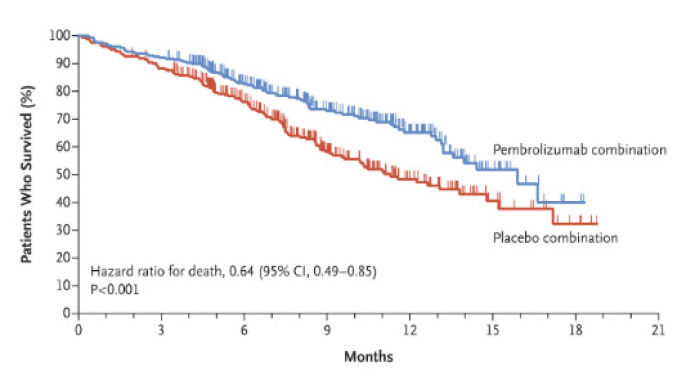

That having been said, the third who do very well often show durable responses. For the first time, we can imagine overall survival (‘Kaplan-Meier’) curves (see opposite) that not only separate between treatment and placebo, but where the treatment arm does not inevitably reach 0% still alive after long-term follow-up. A small minority can dare to dream of a functional cure. In aggregate though, the incremental benefit of adding checkpoint therapy in first-line lung cancer is measured in terms of a few months of additional life.

Moreover we have, by and large, failed to ditch the cytotoxics. As the chart above illustrates, chemotherapy is still widely co-administered with checkpoint inhibitors, even though they harm the immune system. The overall doses given and sequencing of the therapies has been nuanced, but cancer therapy is still arduous for many patients, impacting quality of life. If one were certain that a curative outcome were on the table, then a year of suffering side effects might seem a compelling risk/reward. However, this is not the reality for most.

And what about the ‘Immune primers’? These have proven even less fruitful. The receptors for OX-40, IDO, IL-2 and IL-12 have not proven to be viable druggable targets, leading to products either lacking meaningful efficacy or having unacceptable side effect issues, even in melanoma. As one can imagine, turning the immune system up to 11 is going to unleash some side effect risks. It is also important to remember that the awful feelings of fatigue and muscle pain associated with ‘flu come not from the virus but from these immune stimulating chemicals being produced in response to it. Administering them to anyone is going to be unpleasant.

Ends and Means

Checkpoint inhibitors and immune stimulators have not been the only avenues of innovation. Cell therapies, bi-specific antibodies, antibody-drug-conjugates and expansions of the oral tyrosine kinase inhibitor armamentarium have, at the margin, helped to push those Kaplan-Meier plots rightwards. Indubitably, a well-insured American receiving a cancer diagnosis today is in a far better place than they were a decade ago.

However, we are not talking about a paradigm shift. Despite all manner of accelerated approval pathways and compassionate use programmes, this incremental and often halting progress is hard fought, in terms of the years of clinical development and in terms of dollars. Working out just how much gets spent globally on cancer clinical trials is difficult, but there are a range of estimates out there spanning a range of $30-70 billion dollars per annum.

Let’s take the midpoint of $50bn and reflect on how much progress we have gotten since the launch of the first checkpoint inhibitor for a collective spend of $550 billion. That’s a lot of cash and recoupling this ‘investment’ drives prices higher: spending on cancer medicines in the US and EU has more than tripled in the past 15 years and is now a double-digit percentage of total drug spend. The average annual cost of therapy for a novel oncology drug is ~$150,000. This cannot continue.

Notwithstanding this wall of money, picking winners is getting harder as well. The US Government website clinicaltrials.gov currently lists 1,820 phase 3 or phase 4 cancer trials that are actively recruiting patients and there are some 800 molecules in clinical development programmes. Keeping track of all of this is becoming a full-time job in itself.

The Art of Seeing

The keen-eyed will be wondering what happened to the diagnostics comment in the third paragraph; wait no more. Whilst a Kaplan-Meier plot offers a definitive hard endpoint when comparing one intervention to another in a given situation, a positive outcome does not necessarily contribute to a meaningful shift in the number that society tracks more broadly – overall cancer survival. A drug intervention may be robust, but it may apply only to a sub-set of patients with rare conditions and maybe add only weeks or months to life expectancy.

Despite all of the scientific progress, the key determinant of survival remains the stage of disease at the time of diagnosis. For the four most common cancers (lung and colorectal for all, followed by breast and prostate for women and men; these four account for more than half of total new cases), there is a lot of space for tissue to grow and then shed metastases into the body before it’s physical size manifests as disruption of function and becomes obvious, unlike a melanoma for example, where tumours are often easily visible.

As a consequence, symptomatic diagnoses is often in stage III (locally advanced) and stage IV (spread to other sites of the body) of the disease. This makes a huge difference to the likely outcome. For example, the current SEER 5-year survival rate for non-small cell lung cancer is 26% overall, but 64% for a localised, resectable tumour and only 8% for metastatic disease spread beyond the lung. That is an eight-fold difference in your survival odds for the same disease.

Keener minds than ours have tried to estimate the contributions of improved diagnostic tools and surveillance (mammograms and smears, routine PSA testing etc.) versus better medical interventions (drugs and surgical tools) in the overall progress in improved cancer survival. There is a range, but it looks to us to be around 2/3 improved diagnosis and 1/3 improved treatment.

We think this trend is likely to continue. Firstly, it is cheaper and easier to develop a robust diagnostic than it is to develop a novel therapeutic. Secondly, in terms of molecular sophistication, there is a huge amount of opportunity for improving the power and accuracy of such diagnostics and also opportunities to improve workflow efficiency in the collecting and analysing of various sample types.

Finally, we cannot forget that cancer treatment is an arms race; destroy the tumour before it randomly mutates such that the proposed treatment will no longer be viable. We are understanding more and more about these processes and the direction of likely escape mutations. As such, we expect continued diagnostic surveillance to become a larger feature of treatment (and thus share of the treatment wallet).

Point counter point

To the science geek, oncology has been the most exciting area of healthcare investment to follow over the past 10 years and our readers will not struggle to find voluminous and largely impenetrable sell-side tomes on various markets and the key protagonists within them. What most of these reports have failed to do well is to distil all of this down into an investable conclusion beyond “everything’s a buy” and rarely do people try an pick a winner (why bother when the future looks so awesome; just have some skin in the game).

Some 10 years on from all the excitement and more than five years since the launch of BBH, we are prepared to offer an opinion. In aggregate, oncology R&D is not a winning investment opportunity. This may seem a bold statement, so let us elucidate rather than elide:

The clever eggs over at Goldman Sachs have constructed a series of basket indices that track the investment performance of key themes within healthcare. We can compare a concurrent series for GS HC Oncology (innovative cancer medicines) with GS HC Genomics (novel diagnostics companies producing many of the tests referred to previously) and also to the wider Biotechnology sector and to the US S&P500 Healthcare Index.

We will illustrate total returns from the beginning of 2015 (the earliest common date for these two series) to the end of Q3 2021 (when the market started its weird factor bashing of small healthcare companies, which will distort these indices). The total return from the Nasdaq Biotech Index would be +57% and the S&P HC +116%. Genomics would have yielded an impressive +140%. Oncology? A measly +18%, For the cynics who think the choice of Q3 21 an end point is misleading, the underperformance of oncology widens further versus the rest of the market if we follow it through to now, but the smaller Genomics companies get hit hard so the relative performance gap between the two baskets narrows considerably, but is still >30%.

We are not immune to the above and have previously succumbed to oncological obsequity; you’ll find one of our names on some bullish bloviations on the oncology investment opportunities of yore. Over its lifetime, the Trust has made two specific and focused bets on oncology innovation. They both failed, in terms of making acceptable returns, and in achieving the aims that underpinned the investment thesis. We made a third, broader oncology play and this worked in the commercial sense but did not ultimately meet our investment return hurdle rate.

In contrast, we have made a number of investments in diagnostics companies, including some focused on oncology. One of these has failed, but diagnostics overall remains our most lucrative area in terms of returns since inception. There is clearly a lesson in here…

The 2022 ASCO meeting took place in June as usual. It looked pretty dull to us; bereft of meaningful breakthroughs. However, we weren’t really paying that much attention this time, since we aren’t doing oncology R&D plays anymore. There are more transparent, less crowded opportunities out there and that is where we are spending our time.

For the sake of humanity, we hope the progress continues, but our job is not to dish out grant money for noble research endeavours, it is to try and make money for our investors.

We always appreciate the opportunity to interact with our investors directly and you can submit questions regarding the Trust at any time via:

shareholder_questions@bellevuehealthcaretrust.com

As ever, we will endeavour to respond in a timely fashion and we thank you for your continued support during these volatile months.

Paul Major and Brett Darke