Paul and Brett's Alpha

Complex problems, simple solutions?

We always welcome the opportunity to interact with our investors and we have been on the road a fair bit during April, as well as having our AGM (thank you to all those who attended and for the wide-ranging discussion that followed). One recurring observation from these interactions is the excitement that many of you have for hearing opinion on what might be the “next big thing” in healthcare. Usually, people are more taken with cutting-edge coruscations than plodding mundanities of operational improvement.

It would be comforting indeed to imagine there are imminent revolutionary developments that could greatly improve the human condition, but it is rarely so clear cut. Systemic change is typically grinding, incremental and hard to see unfolding except in hindsight. We would love to tell you that we are excited today about, say, Moderna’s personalised cancer vaccine programme or Lilly’s Alzheimer’s drug but we are not.

We want game-changing efficacy in dementia and in the treatment of cancer (especially in respect of side effects) just as much as the next human being, but we have not seen any product or technology that yet warrants such a ‘game-changer’ description. Moreover, we do not agree with Mencken that clear and simple solutions to complex problems are innately wrong.

Indeed, if we distil the many and varied challenges that healthcare faces during a period of unprecedented demographic change and rapid innovation, it all comes down to a rather simple problem – capacity. We all want to be able to see a doctor quickly when we need to and then not wait too long after that for any required treatment. Nevertheless, there are more than 400,000 people in the UK who have been waiting more than one year for an NHS elective procedure.

Rapid turnaround makes economic sense as well as being socially just – the longer you leave a condition untreated, the more likely it is to cause further physical and mental problems for the patient (e.g. joint replacement delay leads to poor mobility, which can then lead to weight gain and attendant cardiovascular and musculoskeletal problems, social isolation, pain medication dependency, loss of income etc. etc.)

We can choose to over-complicate this simplistic conclusion regrading capacity in many different ways: there aren’t enough beds, there aren’t enough doctors or nurses, social care is underfunded and lacks adequate capacity. We don’t have enough hospices etc. etc. For the UK NHS, all of these are true; we lag our European and OECD peers on most of these measures on a population-adjusted basis.

However, that was arguably true five years ago and yet the problems were nowhere near as great. Indeed, many healthcare commentators might argue that the UK was previously seen as something of a model of lean management, coping fine for most of the time (i.e. except winter) in most years.

Politicians will argue that each of these problems lacks a simple (i.e. affordable) solution and each has myriad causes that have been decades in the making. Compounding so many complex problems is surely a certain route to failure when it comes to solving them. Thankfully, whilst the politicians vacillate and kick the can down the road, the healthcare industry is innovating. Why bother conflating, when there is a simple solution to them all?

A simple rather than a complex problem?

The primary issue behind the headline-grabbing issues of waiting lists, ambulance delays and access to treatment is a lack of available acute care beds. If you are going to cut someone open in an elective surgical procedure, you need a safe environment for their body to recover and heal and ensure that relevant follow-up care is provided. You might also need to educate the patient or their caregivers on any continuing care thereafter (medication, physical therapy exercises, diet, etc.).

This recovery period need not be that long. According to the King’s Fund, 80% of all elective procedures undertaken by the NHS should be day cases (i.e. no overnight stay). Elective procedures account for around 85% of overall volume and thus day cases are around 68% of total surgical caseload.

In many private UK hospitals, you will see a bed turned twice over in a day; the first round of admissions is early morning followed by a morning surgery schedule. Many of the beds will be empty by midday and turned around for a new occupant in time for a second early-afternoon surgical roster, with the aim of getting those patients home for prime-time TV.

Anyone who has been to a private hospital will know that such rapid turnarounds are only possible through ensuring that the elective procedure is booked on a date and time when the patient can be sure that there will be someone waiting for them at home to look after them. Post-surgical soreness and swelling can limit mobility and anaesthesia often causes light headedness for several hours. Certain musculoskeletal procedures can require many days of minimal physical activity (and the wearing of those hideous knee-length compression socks)

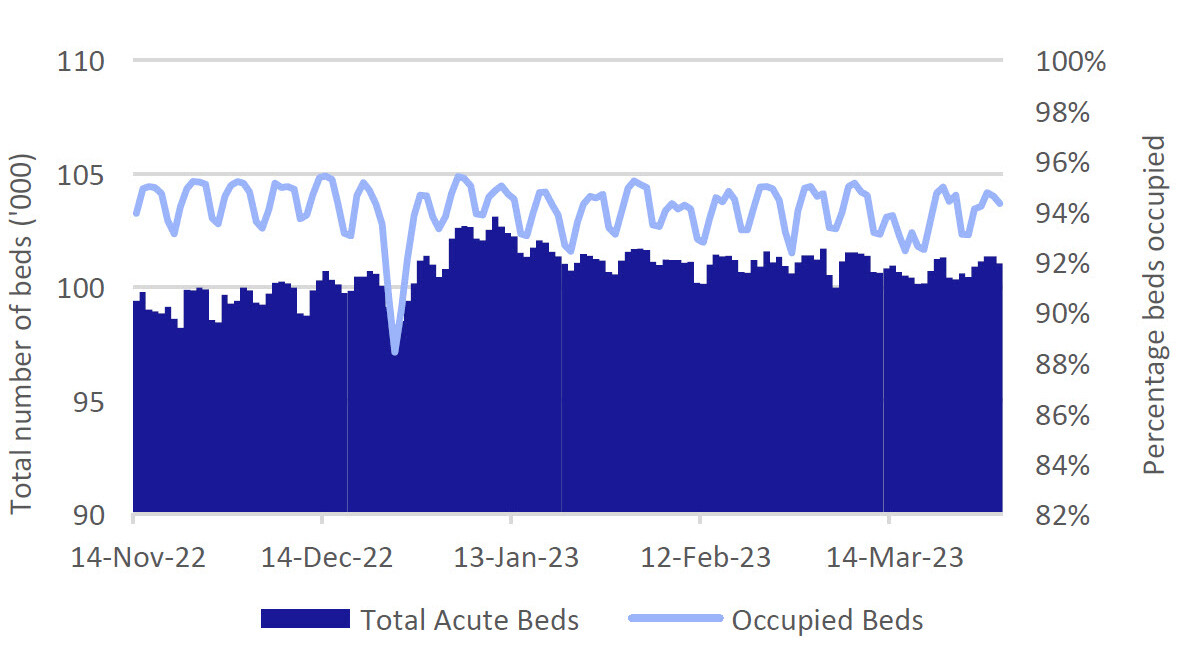

So much for the theory of optimised day case management. What does the data tell us about the performance of our benighted health service? We have included two charts using data over the busy winter period from the NHS’ own data warehouse, which is available online for public interrogation.

The data in Figure 5 below might, at first glance, suggest a model of efficiency and good management: occupancy is always high, but never total and those nice people in charge do everything they can to keep people home on Christmas day.

Of course, this is national-level data and the supply demand imbalance can look very different from one area to another. If you are waiting for a bed in Colchester for your hip operation, the availability of one in Cleethorpes is of little use. If there were always free space, then surely there wouldn’t be such long waiting lists for elective procedures, queues of ambulances and all the rest?

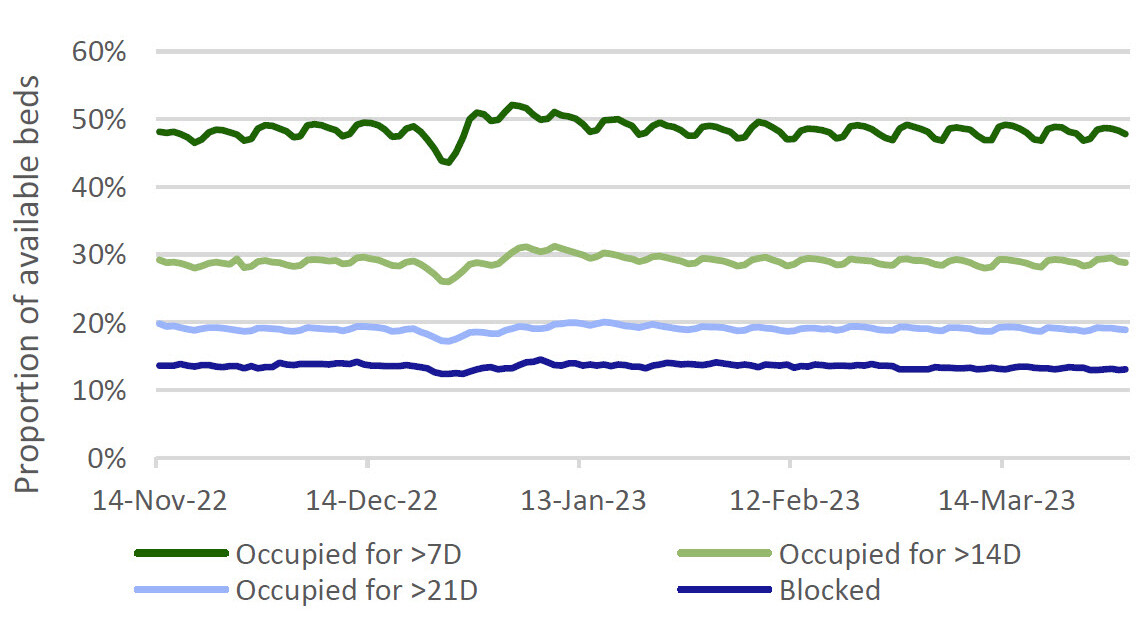

This chart tells us nothing about who is in these beds and one more level of granularity paints a very different picture. Figure 6 below shows proportional occupancy for longer periods and also beds that are blocked (this is when the patient is considered to be safe for discharge into the community with suitable support, but where such support is not available).

Given the previous data points showing that more than two thirds of surgical cases are day cases and only one in seven are emergency admissions, it really is quite staggering to think that, at any given moment, around half of the people in hospital in England have been there for more than one week, some more than three weeks and that one in six of them have no medical need to be there at all.

And then there is the cost. Every extra day sat in an acute care bed costs the NHS £350-500. With around 12,000 beds blocked at any one time, that is £5.1m per day being wasted and probably multiples of that again being mis-spent through excessive stay length.

Leaving aside the undoubtable truth that no-one wants to be in hospital for any length of time, a prolonged period of bed rest is not good for you and doubly so if you are old and more inclined to suffer muscle wastage.

In addition to the physical and mental health aspects, the food is unconscionably terrible – vegetables boiled longer than some of these waiting lists and all flavourful elements (evil sugar and deadly salt) banished. That alone is enough to make you ill. Where does this leave us?

A simple rather than a complex solution

Making a comparison to the UK private sector is of course unfair, because that service cherry-picks the simple cases. If it appears that you might be high risk or that you won’t be able to put your own post-operative care in place, then they won’t admit you for a procedure.

However, it remains objectively true that, for the majority of the case volume, the post-procedure medical requirements are limited: ongoing medication, some vitals monitoring and rapid access to a nurse or doctor in the event that your condition worsens. Why do you need to be in hospital at all?

The elegant solution to all of this is home healthcare. We are not talking about meals on wheels, we are talking about a concept the NHS calls the “virtual ward” and its simplicity is beguiling…

Coming back to the early comments about the next big thing: we would love to tell you this is all clever and high tech, but it really isn’t. If you were of a bootstrapping mindset, you could create a virtual care environment with some clever coding and a few rudimentary gadgets available from Amazon: a tablet computer, a pulse oximeter, a digital thermometer and a digital blood pressure cuff.

You could take things up a gear again with some digital scales and a smart watch. Let’s add in a 5G internet dongle as well, just in case your broadband is a bit dodgy.

With these tools suitably linked to the tablet and the tablet linked to the internet, a third party could remotely monitor your critical vital signs just as easily and regularly as if you were sat in a hospital bed. They could use the tablet and a video calling suite to offer regular check-ins and watch as you took your medication.

You may need some specialist care – a blood draw say, some infused medication or a dressing changed. That’s fine, this third party can send a skilled nurse to you and they can travel around seeing multiple patients every day for such procedures.

If your vitals started to deteriorate, advice could be given or, in a worst case scenario, a paramedic dispatched. If you pass out or have a fall, the accelerometers in the smart watch will send an alert. The scales can make sure that you are eating well (much more likely outside of the hospital than in it).

The total cost of all of this equipment is probably less than the cost of a two-day hospital stay. For those with additional mobility needs, other equipment could be loaned as well (riser recliner chairs, walking frames, commodes etc.).

Because the majority of post-admission cases are thankfully uncomplicated, the amount of staff needed to run such a programme remains an open question. As of March 2023, there were 340 pilot “virtual ward” programmes running in NHS England, serving ~7,700 patients (each patient is referred to as a “virtual bed”) that had treated and discharged >100,000 patients since inception.

The levels of staffing vary considerably across these but one can easily imagine that the tablet will be sending regular updates and these can all be monitored algorithmically. When things step out of range or a check-in is missed, a human can be brought into the loop.

If you think about how few actual minutes of any day in hospital include a nurse or doctor at the bedside, the ability to scale up a large ward from a small control room that is manned 24/7 becomes all too obvious. The potential cost savings resulting from this are also very obvious.

It will take time to gather sufficient data on longer-term outcomes, patient satisfaction and, critically, re-admission rates. Broadly speaking, literature from pilot programmes across the world thus far is favourable in terms of no worse outcomes, positive patient feedback and cost savings. In summary, this feels much more like the future of healthcare than most of the things we see and talk about.

Making money

We cannot realistically make money from an NHS initiative using largely ‘off the shelf’ technologies from multiple vendors. However, we can find examples of third party service providers in the US to play this accelerating transition toward quality care at home.

We selected two companies – Option Care Health and Amedisys – to provide exposure to this theme within the portfolio. We have a third portfolio company that is also geared toward home care but in a specific niche (haemodialysis) and is thus not relevant to the discussion in this month’s missive.

Amedisys (AMED) is one of the leading providers of Home Health Services (i.e. helping patients recovering from illness or surgery and the prevention of avoidable hospital readmissions, patients living with chronic disease and providing physical, speech and occupational therapy in the home setting. These activities account for ~60% of revenues).

AMED also has a hospice unit offering end of life care in the home setting, which accounts for ~35% of revenues. The remainder is a more typical Personal Care offering that provides daily living assistance. The Company operates in 39 US states and serves more than 400,000 patients annually.

Two of AMED’s largest competitors, Kindred at Home and LHC Group were acquired in 2021 and 2023 respectively by large insurance providers (Humana and United Health/Optum respectively) to help those groups facilitate the transition to value-based-care (‘VBC’) contracting.

Option Care (OPCH) is the leading independent provider of alternate site infusion services in the US with ~21% market share of this $11bn, rapidly-consolidating industry. OPCH offers a wide range of chronic and acute therapies to patients either in their homes or at the Company's ambulatory infusion centres. Although there are three large players (two of which are owned by insurers), around 40% of the US infusion market is still in the hands of local ‘mom and pop’ operators.

Option Care Health has benefited from multiple tailwinds: an ageing population is driving increased chronic use of infused medications and uptake of the Medicare Advantage insurance schemes that its business serves. Investor interest has grown around the (allegedly) burgeoning opportunity in anti-amyloid Alzheimer’s treatments. If you cannot work out which drug is the winner, far better to play the volume upside from the product-neutral administrator of them all.

In contrast, Amedisys’ operating environment has been challenged in recent years by the vagaries of government reimbursement for traditional Medicare on which it is highly dependent (as opposed to Medicare Advantage, which has different contracting rate arrangements and to which AMED historically has had limited exposure), and the labour environment where high turnover, wage inflation and commensurate reliance on agency staff has pressured margins.

We have long felt that a combination of these two companies would be compelling in the long term, but were surprised by the timing of OPCH’s bid for Amedisys on 3rd May 2023. Thus far, the deal has not been well received by the market, with some chatter around OPCH holders being disgruntled at the growth opportunity for the company being diluted with the drag of turning around AMED.

We think this is a very short-term view. The aforementioned ongoing transition in the US to value-based-care models is likely to drive more and more providers into vertically-integrated full service provision so that they can contract directly with physician groups and payors in ‘at risk’ arrangements.

We expect these trends to consolidate industry segments and squeeze out ‘mom and pop’ services, operators and smaller physician practice groups. Like insurance itself, VBC relies on risk-pooling and size is your friend in such arrangements.

At first glance, one might argue that AMED is in a more difficult spot, has lower growth and margins and the apparent synergy targets ($50m from a $1.6bn combined cost base and only $25m of revenue synergies from a combined revenue base of $6.5bn) seem uncompelling. We think this is a short-sighted view.

Firstly, this is a human capital business and the labour market in home care and nursing has already seen a lot of turnover since COVID. The last thing you want to do is disrupt operations in the run-up to the closing and integration with nurses leaving because they fear they will become a synergy (we expect much larger cost savings from the middle and back office areas being combined).

Secondly, the revenue synergy target is a complex discussion. The real synergies will not arise from the market that the companies serve today, but rather emerge as the VBC transition gathers pace (and it will – ask any major payor in the US). We would imagine that, since this deal was announced, the management team of Option Care have been inundated with customer enquiries about what the combined entity might be able to offer them. Time will tell, but we expect larger cost and revenue synergy forecasts to be forthcoming after the deal has closed.

The past two years have been extremely challenging for our strategy; this macro-focused market dynamic is leading investors to eschew growth and longer-duration investment cases, both significant characteristics of our approach. Behind this, the wider healthcare market dynamic continues to evolve in the direction that we hoped and expected that it would and this leaves us optimistic that we will be rewarded appropriately in the fullness of time.

We always appreciate the opportunity to interact with our investors directly and you can submit questions regarding the Trust at any time via:

shareholder_questions@bellevuehealthcaretrust.com

As ever, we will endeavour to respond in a timely fashion and we thank you for your continued support during these volatile months.

Paul Major and Brett Darke